44+ why don't banks recommend reverse mortgages

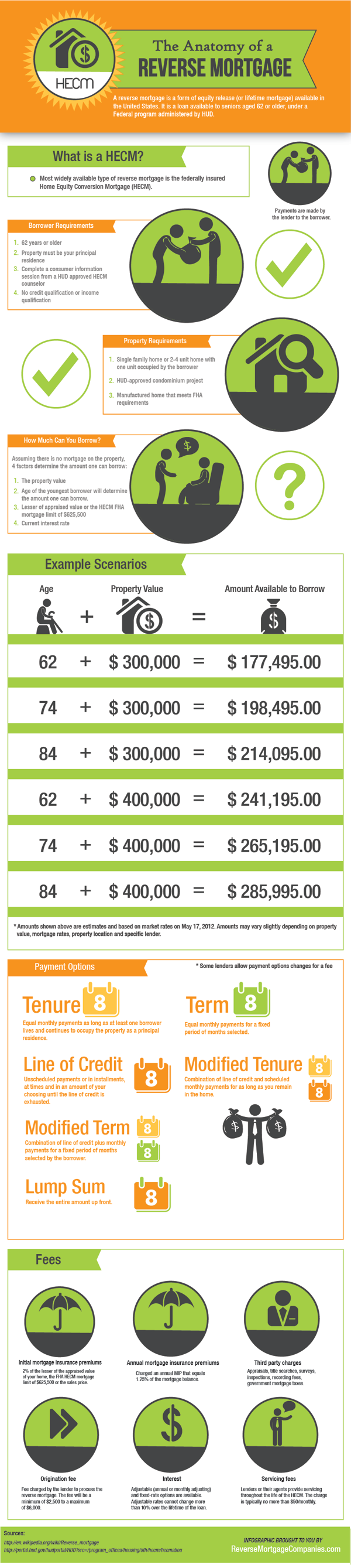

An Overview Of Reverse Mortgage And How It Works. HECMs make sense for most properties valued at less than 1.

Reverse Mortgages Might Not Be A Bad Move For Many Retirees

Web The FHA limits the origination and servicing fees charged by reverse mortgage lenders.

. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Get the home of your dreams with a non-conforming loan from NASB. Another alternative to a reverse mortgage is to sell your home to your children.

If they do not offer them their people dont recommend. Proceeds from a reverse mortgage loan are usually tax. Ad Sometimes good borrowers dont fit into standard loan guidelines and are denied.

Ad While there are numerous benefits to the product there are some drawbacks. Web A reverse mortgage is a special type of home equity loan sold to homeowners aged 62 and older. Web For the average reverse mortgage youre looking at 10000 to 20000 in closing costs says Daniel Marske sales manager and home equity conversion.

Get Free Info Now. Ad Looking For Reverse Mortgage For Seniors. Web Banks either offer reverse mortgages or they do not.

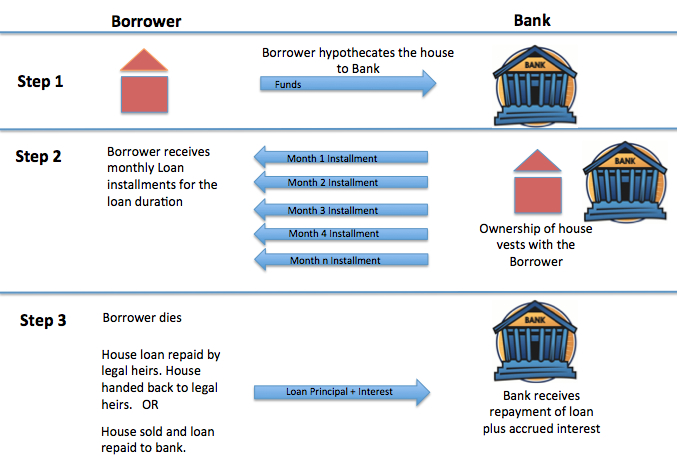

Web A reverse mortgage is a type of home loan that lets you convert a portion of the equity in your house into cash. Sell Your Home to Your Children. Web A reverse mortgage can be an expensive way to borrow.

One approach is a sale-leaseback. Web Single-purpose reverse mortgages also arent federally insured so lenders dont have to charge mortgage insurance premiums. Get a Free Information Kit Reverse Mortgage Calculator and Consumer Guide.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. Web A reverse mortgage is a home loan that allows homeowners ages 62 and older to withdraw home equity and convert it into cash.

Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Ad Compare the Best Reverse Mortgage Lenders In The Nation. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. If they offer them they do not tell people theyre a bad product.

Web One of the upsides of a reverse mortgage is that lenders characteristically dont impose income or credit requirements. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Find Out In Less Than 2 Minutes If A Reverse Mortgage Is Right For You.

Borrowers dont have to pay. Reverse Mortgage Pros and. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

It takes part of the equity in your home and converts it. With regular mortgages borrowers make monthly.

Important About Personal Finance Basics Definition Example Tips

What Is A Reverse Mortgage Quora

Reverse Mortgages Aren T Just For People Who Are Out Of Money Bloomberg

Fixed Rate Mortgage How Does Fixed Rate Mortgage Work With Its Types

Understanding Cash And Cash Equivalents Types And Examples

13 Reverse Mortgage Marketing Ideas Brandongaille Com

Banks Taking Tick Box Approach To Reverse Mortgage Risks Asic

Reverse Mortgages

6 Best Banks Offering Reverse Mortgages In 2023 Reversemortgagereviews Org

Current Reverse Mortgage Rates Today S Rates Apr Arlo

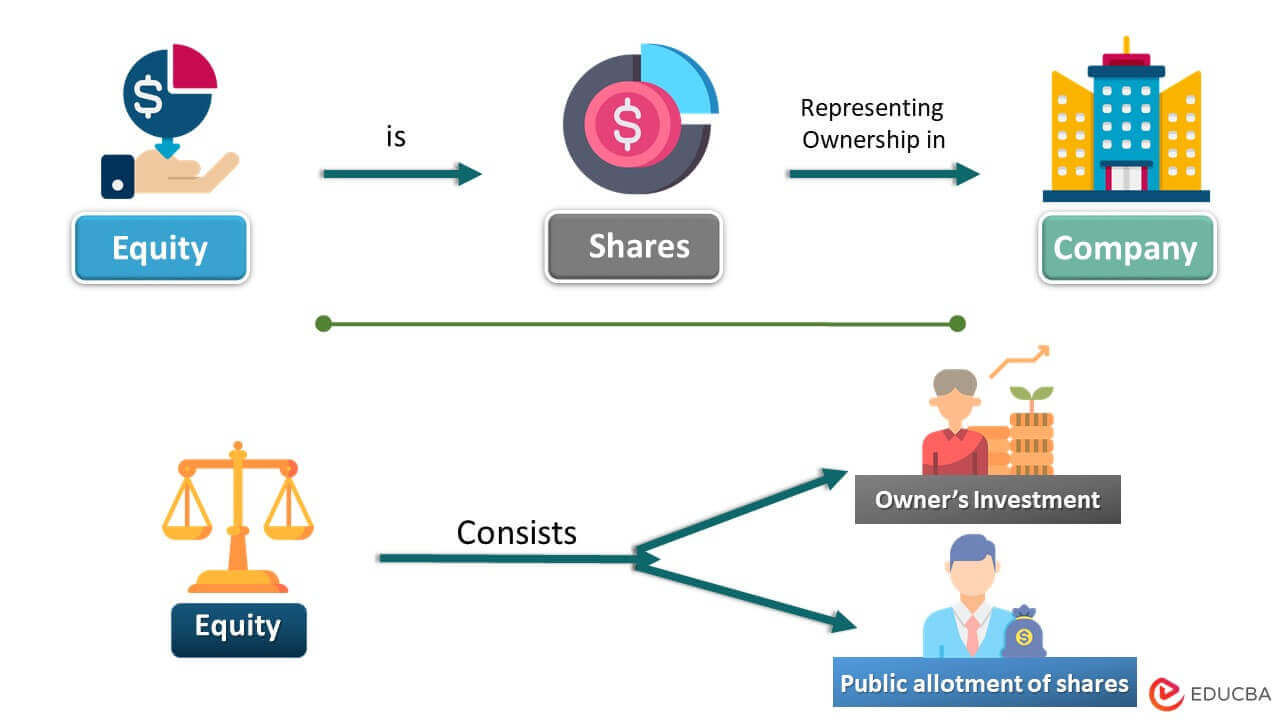

Equity Meaning Formula Examples Calculation Importance

Reverse Mortgage Definition And Benefits Abc Of Money

What Is The Number One Reason That Banks Don T Recommend Reverse Mortgages Quora

Reverse Mortgage Dos Don Ts Chip

Here Are The Banks That Offer Reverse Mortgages 2023 List

Soaring Number Of Older Home Owners Take Out Government Backed Reverse Mortgages

Reverse Mortgage What It Is And Why It S A Bad Idea